Home > Salary > United States > Senior Tax Associate A senior tax associate is a professional who specializes in providing tax services and advice to clients. They work closely with clients to ensure compliance with tax laws and regulations, while also identifying opportunities for tax savings and minimizing liabilities. Senior tax associates are responsible for preparing and reviewing tax returns, conducting research on complex tax issues, and assisting with tax planning strategies. They may also be involved in representing clients during tax audits and providing guidance on tax implications of business transactions. This role requires strong analytical and problem-solving skills, as well as a thorough understanding of tax laws and regulations. Effective communication and client management skills are also essential for building and maintaining relationships with clients.

A senior tax associate is a professional who specializes in providing tax services and advice to clients. They work closely with clients to ensure compliance with tax laws and regulations, while also identifying opportunities for tax savings and minimizing liabilities. Senior tax associates are responsible for preparing and reviewing tax returns, conducting research on complex tax issues, and assisting with tax planning strategies. They may also be involved in representing clients during tax audits and providing guidance on tax implications of business transactions. This role requires strong analytical and problem-solving skills, as well as a thorough understanding of tax laws and regulations. Effective communication and client management skills are also essential for building and maintaining relationships with clients.

Estimated Yearly Salary: 82,862 USD

Estimated Monthly Salary: 6,905 USD

Estimated Weekly Salary: 1,594 USD per week

Estimated Hourly Salary: 40 USD per hour

Values are pre-tax

Values are pre-tax

Last revision of data: 2025-01-04

Last revision of data: 2025-01-04

Estimated Monthly Salary: 6,679 USD

Estimated Weekly Salary: 1,541 USD per week

Estimated Hourly Salary: 39 USD per hour

Last revision of data: 2024-01-02

Last revision of data: 2024-01-02

Estimated Yearly Salary: 83,131 USD

Estimated Monthly Salary: 6,928 USD

Estimated Weekly Salary: 1,599 USD per week

Estimated Hourly Salary: 40 USD per hour

Difference in salary year over year or average salary increase is approximately 3 %

3 %

Data confidence is - relatively high

Data fetched from dabase: 14 submissions.

Results are anonymized. Amounts indicated are pre-tax, meaning no deductionts yet have been made to the basic salary. Salaries where there are less than 3 entries are not displayed.

Want to check how your salary compares? Submit your own salary here

Estimated Yearly Salary: 82,862 USD

Estimated Monthly Salary: 6,905 USD

Estimated Weekly Salary: 1,594 USD per week

Estimated Hourly Salary: 40 USD per hour

By working as Senior Tax Associate a person can save up to 4,648 USD per month or 55,771 USD yearly. Values are pre-tax.

NOTE: These values are estimates and are averaged for the whole country. Furthermore the value is likely exaggerated as no other expenses are taken into account in the projection. Unessential expenses are very subjective and are difficult to assess. Most likely the previously estimated number is significantly lower for majority of people. Expenses in different cities across the country may vary. Above values accuracy is low and is based on limited set of data obtained.

For more information regarding expenses in United States, see costs of living in United States.

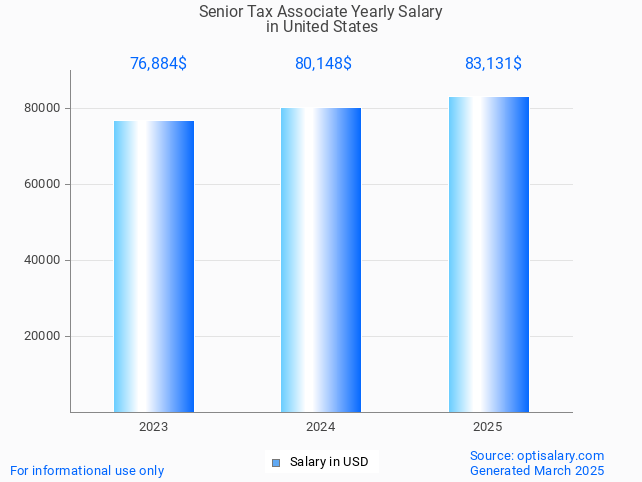

Estimated Yearly Salary for Senior Tax Associate

Last revision of data: 2025-01-04

Last revision of data: 2025-01-04

Data as of 2025

Data as of 2025

Random salary:

People operations manager (78,421 USD per year, pre-tax.)

Managing consultant (127,830 USD per year, pre-tax.)

Orthotics technician (34,172 USD per year, pre-tax.)

Wan engineer (86,229 USD per year, pre-tax.)

Army sergeant first class cavalry (77,302 USD per year, pre-tax.)

Senior Tax Associate salary in United States

Average Yearly Salary of Senior Tax Associate in United States is approximately 82,862 USD (83,131 USD). Data is for 2025 and indicates a pre-tax value. The salary itself depends on multiple factors such as seniority, job performance, certifications, experience or any other bonuses. The value indicated is an average amount based on records we have in database. Real values may vary. The data is for orientational purposes.

What does Senior Tax Associate do?

A senior tax associate is a professional who specializes in providing tax services and advice to clients. They work closely with clients to ensure compliance with tax laws and regulations, while also identifying opportunities for tax savings and minimizing liabilities. Senior tax associates are responsible for preparing and reviewing tax returns, conducting research on complex tax issues, and assisting with tax planning strategies. They may also be involved in representing clients during tax audits and providing guidance on tax implications of business transactions. This role requires strong analytical and problem-solving skills, as well as a thorough understanding of tax laws and regulations. Effective communication and client management skills are also essential for building and maintaining relationships with clients.

A senior tax associate is a professional who specializes in providing tax services and advice to clients. They work closely with clients to ensure compliance with tax laws and regulations, while also identifying opportunities for tax savings and minimizing liabilities. Senior tax associates are responsible for preparing and reviewing tax returns, conducting research on complex tax issues, and assisting with tax planning strategies. They may also be involved in representing clients during tax audits and providing guidance on tax implications of business transactions. This role requires strong analytical and problem-solving skills, as well as a thorough understanding of tax laws and regulations. Effective communication and client management skills are also essential for building and maintaining relationships with clients.

Skills: senior tax associate, tax services, tax compliance, tax planning, tax returns, tax audits

Job industry: Accounting

Job industry: Accounting

How much does Senior Tax Associate make?

Salary details

How much does Senior Tax Associate make?Estimated Yearly Salary: 82,862 USD

Estimated Monthly Salary: 6,905 USD

Estimated Weekly Salary: 1,594 USD per week

Estimated Hourly Salary: 40 USD per hour

Comparing salary to last year:

Estimated Yearly Salary: 80,148 USDEstimated Monthly Salary: 6,679 USD

Estimated Weekly Salary: 1,541 USD per week

Estimated Hourly Salary: 39 USD per hour

Senior Tax Associate estimated salary in USD

For easier comparison here is an estimated salary in USD:Estimated Yearly Salary: 83,131 USD

Estimated Monthly Salary: 6,928 USD

Estimated Weekly Salary: 1,599 USD per week

Estimated Hourly Salary: 40 USD per hour

Difference in salary year over year or average salary increase is approximately

3 %

3 % About these results

About these results

Data confidence is - relatively high Data fetched from dabase: 14 submissions.

Results are anonymized. Amounts indicated are pre-tax, meaning no deductionts yet have been made to the basic salary. Salaries where there are less than 3 entries are not displayed.

Want to check how your salary compares? Submit your own salary here

Compare salary to other countries

Please type in your occupation and select desired country to see latest trends in salaries.

Country:

Salary comparison to National average

The United States of America, often called the USA, is a vast and diverse country in North America. It is home to approximately 331 million people, making it the third most populous nation globally. The USA spans about 9.8 million square kilometers, encompassing various landscapes, climates, and cultures.

Estimated national average yearly salary is 57,000 USD (57,000 USD). Value indicated is pre-tax. Below graph shows estimated Senior Tax Associate job salary compared to average salary in United States.

Comparison shows that a person working as Senior Tax Associate in United States earns on average:

1.45 times the average salary (or 145% of average salary).

Estimated national average yearly salary is 57,000 USD (57,000 USD). Value indicated is pre-tax. Below graph shows estimated Senior Tax Associate job salary compared to average salary in United States.

Comparison shows that a person working as Senior Tax Associate in United States earns on average:

1.45 times the average salary (or 145% of average salary).

Is Senior Tax Associate a well paid job?

Yes, our data shows that Senior Tax Associate is a well paid job. With years and experience the salary might increase even further, resulting in higher satisfaction.What is considered a high salary for Senior Tax Associate?

High salary for Senior Tax Associate would be somewhere between 91,148 USD and 120,150 USD. However this is an estimation based on Gaussian Distribution.How much can you save working as Senior Tax Associate in United States?

Living in United States the approximate monthly expenses are: 2,280 USD. This amount covers basic needs such as food, housing, clothing, healthcare and education costs for a single person. No luxury expenses such as traveling, leisure, hobbies are included in the estimation.Estimated Yearly Salary: 82,862 USD

Estimated Monthly Salary: 6,905 USD

Estimated Weekly Salary: 1,594 USD per week

Estimated Hourly Salary: 40 USD per hour

By working as Senior Tax Associate a person can save up to 4,648 USD per month or 55,771 USD yearly. Values are pre-tax.

NOTE: These values are estimates and are averaged for the whole country. Furthermore the value is likely exaggerated as no other expenses are taken into account in the projection. Unessential expenses are very subjective and are difficult to assess. Most likely the previously estimated number is significantly lower for majority of people. Expenses in different cities across the country may vary. Above values accuracy is low and is based on limited set of data obtained.

For more information regarding expenses in United States, see costs of living in United States.

Salary comparison to region and neighbouring coutries

Country's neighbours are: Canada, Mexico. To make it easier for comparison a conversion from local currency to USD has been made (conversion rates may vary).Estimated Yearly Salary for Senior Tax Associate

Salary increase per years of experience

Based on data available the salary increase per years of experience is as following- 0 years (beginner) equals base salary

- 1 to 5 years of experience yields

+12% salary increase

+12% salary increase- 6 to 10 years of experience yields

+25% salary increase

+25% salary increase- 11 to 15 years of experience yields

+16% salary increase

+16% salary increase- 16 to 25 years of experience yields

+9% salary increase

+9% salary increase- more than 25 years of experience yields

+10% salary increase

+10% salary increaseTop 10 highest salaries in United States

(596,532 USD per year, pre-tax.)

2. Cardiologist

(494,239 USD per year, pre-tax.)

(477,143 USD per year, pre-tax.)

(464,258 USD per year, pre-tax.)

5. Neurosurgeon

(461,910 USD per year, pre-tax.)

(453,166 USD per year, pre-tax.)

7. Oncologist

(453,108 USD per year, pre-tax.)

8. Urologist

(452,974 USD per year, pre-tax.)

(452,428 USD per year, pre-tax.)

(451,412 USD per year, pre-tax.)

Random salary:

People operations manager (78,421 USD per year, pre-tax.)

Managing consultant (127,830 USD per year, pre-tax.)

Orthotics technician (34,172 USD per year, pre-tax.)

Wan engineer (86,229 USD per year, pre-tax.)

Army sergeant first class cavalry (77,302 USD per year, pre-tax.)

Feedback about these results

Please provide feedback by clicking buttons below if you find any of our salaries erroneous.

Link to this graph - use the following code to display the salary graph on your page:

<a href='https://optisalary.com/salary?country=united-states&job=senior-tax-associate'><img src='https://optisalary.com/wp-content/graphs/salary/senior-tax-associate-salary-in-united-states-2025.jpg' alt='senior tax associate salary in united states 2025' title='senior tax associate salary in united states 2025' /></a>

Please note:The salary figures presented here are intended for reference purposes solely.

The salary estimates on this website are meant for informational use only. We compile salary data from varied sources, but do not ensure absolute accuracy. Users should on their own confirm salaries before making financial decisions. Salary fluctuations occur due to industry standards, demand shifts, and location. We deny any guarantee regarding the correctness of the provided salary data. By accessing this site, you acknowledge that salary data is not definitive.

The salary estimates on optisalary.com are meant for reference use exclusively. We compile salary data from varied sources, but do not guarantee absolute accuracy. Users must on their own verify salaries before making career commitments. Salary fluctuations occur due to industry standards, demand shifts, and location. We deny any guarantee regarding the validity of the provided salary data. By using this site, you acknowledge that salary data is not definitive.