Home > Salary > Malaysia > Tax Consultant A tax consultant is a professional who provides expert advice and guidance on tax-related matters to individuals, businesses, and organizations. Their primary role is to help clients navigate the complex world of taxation by ensuring compliance with tax laws and regulations, minimizing tax liabilities, and maximizing tax benefits and incentives. Tax consultants are responsible for analyzing financial records, preparing tax returns, identifying potential tax deductions and credits, and staying up-to-date with changes in tax legislation. They also assist in tax planning strategies, resolving tax disputes, and representing clients during tax audits.

A tax consultant is a professional who provides expert advice and guidance on tax-related matters to individuals, businesses, and organizations. Their primary role is to help clients navigate the complex world of taxation by ensuring compliance with tax laws and regulations, minimizing tax liabilities, and maximizing tax benefits and incentives. Tax consultants are responsible for analyzing financial records, preparing tax returns, identifying potential tax deductions and credits, and staying up-to-date with changes in tax legislation. They also assist in tax planning strategies, resolving tax disputes, and representing clients during tax audits.

Estimated Yearly Salary: 108,949 MYR

Estimated Monthly Salary: 9,079 MYR

Estimated Weekly Salary: 2,095 MYR per week

Estimated Hourly Salary: 52 MYR per hour

Values are pre-tax

Values are pre-tax

Last revision of data: 2025-01-04

Last revision of data: 2025-01-04

Estimated Monthly Salary: 8,802 MYR

Estimated Weekly Salary: 2,031 MYR per week

Estimated Hourly Salary: 51 MYR per hour

Last revision of data: 2024-01-02

Last revision of data: 2024-01-02

Estimated Yearly Salary: 21,790 USD

Estimated Monthly Salary: 1,816 USD

Estimated Weekly Salary: 419 USD per week

Estimated Hourly Salary: 10 USD per hour

Difference in salary year over year or average salary increase is approximately 3 %

3 %

Data confidence is - relatively high

Data fetched from dabase: 14 submissions.

Results are anonymized. Amounts indicated are pre-tax, meaning no deductionts yet have been made to the basic salary. Salaries where there are less than 3 entries are not displayed.

Want to check how your salary compares? Submit your own salary here

Estimated Yearly Salary: 108,949 MYR

Estimated Monthly Salary: 9,079 MYR

Estimated Weekly Salary: 2,095 MYR per week

Estimated Hourly Salary: 52 MYR per hour

By working as Tax Consultant a person can save up to 1,105 USD per month or 13,256 USD yearly. Values are pre-tax.

NOTE: These values are estimates and are averaged for the whole country. Furthermore the value is likely exaggerated as no other expenses are taken into account in the projection. Unessential expenses are very subjective and are difficult to assess. Most likely the previously estimated number is significantly lower for majority of people. Expenses in different cities across the country may vary. Above values accuracy is low and is based on limited set of data obtained.

For more information regarding expenses in Malaysia, see costs of living in Malaysia.

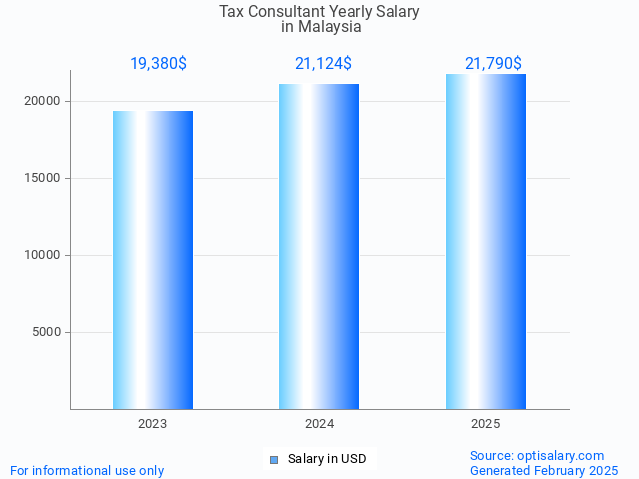

Estimated Yearly Salary for Tax Consultant

Last revision of data: 2025-01-04

Last revision of data: 2025-01-04

Data as of 2025

Data as of 2025

Random salary:

Department chair (college university) (144,430 MYR per year, pre-tax.)

Business sales manager (93,129 MYR per year, pre-tax.)

Church choir director (28,982 MYR per year, pre-tax.)

Boat mechanic (48,523 MYR per year, pre-tax.)

Takeoff engineer (63,955 MYR per year, pre-tax.)

Tax Consultant salary in Malaysia

Average Yearly Salary of Tax Consultant in Malaysia is approximately 108,949 MYR (21,790 USD). Data is for 2025 and indicates a pre-tax value. The salary itself depends on multiple factors such as seniority, job performance, certifications, experience or any other bonuses. The value indicated is an average amount based on records we have in database. Real values may vary. The data is for orientational purposes.

What does Tax Consultant do?

A tax consultant is a professional who provides expert advice and guidance on tax-related matters to individuals, businesses, and organizations. Their primary role is to help clients navigate the complex world of taxation by ensuring compliance with tax laws and regulations, minimizing tax liabilities, and maximizing tax benefits and incentives. Tax consultants are responsible for analyzing financial records, preparing tax returns, identifying potential tax deductions and credits, and staying up-to-date with changes in tax legislation. They also assist in tax planning strategies, resolving tax disputes, and representing clients during tax audits.

A tax consultant is a professional who provides expert advice and guidance on tax-related matters to individuals, businesses, and organizations. Their primary role is to help clients navigate the complex world of taxation by ensuring compliance with tax laws and regulations, minimizing tax liabilities, and maximizing tax benefits and incentives. Tax consultants are responsible for analyzing financial records, preparing tax returns, identifying potential tax deductions and credits, and staying up-to-date with changes in tax legislation. They also assist in tax planning strategies, resolving tax disputes, and representing clients during tax audits.

Skills: tax consultant, tax advisor, tax expert, tax planning, tax compliance, tax law

Job industry: Accounting

Job industry: Accounting

How much does Tax Consultant make?

Salary details

How much does Tax Consultant make?Estimated Yearly Salary: 108,949 MYR

Estimated Monthly Salary: 9,079 MYR

Estimated Weekly Salary: 2,095 MYR per week

Estimated Hourly Salary: 52 MYR per hour

Comparing salary to last year:

Estimated Yearly Salary: 105,620 MYREstimated Monthly Salary: 8,802 MYR

Estimated Weekly Salary: 2,031 MYR per week

Estimated Hourly Salary: 51 MYR per hour

Tax Consultant estimated salary in USD

For easier comparison here is an estimated salary in USD:Estimated Yearly Salary: 21,790 USD

Estimated Monthly Salary: 1,816 USD

Estimated Weekly Salary: 419 USD per week

Estimated Hourly Salary: 10 USD per hour

Difference in salary year over year or average salary increase is approximately

3 %

3 % About these results

About these results

Data confidence is - relatively high Data fetched from dabase: 14 submissions.

Results are anonymized. Amounts indicated are pre-tax, meaning no deductionts yet have been made to the basic salary. Salaries where there are less than 3 entries are not displayed.

Want to check how your salary compares? Submit your own salary here

Compare salary to other countries

Please type in your occupation and select desired country to see latest trends in salaries.

Country:

Salary comparison to National average

Malaysia is a Southeast Asian country located on the Malay Peninsula and the island of Borneo. It has a diverse population consisting of various ethnic groups, including Malays, Chinese, Indians, and indigenous tribes. Malaysia has an estimated population of around 32 million people. The country covers an area of approximately 330,803 square kilometers, making it the 66th largest country in the world.

Estimated national average yearly salary is 78,260 MYR (17,780 USD). Value indicated is pre-tax. Below graph shows estimated Tax Consultant job salary compared to average salary in Malaysia.

Comparison shows that a person working as Tax Consultant in Malaysia earns on average:

1.39 times the average salary (or 139% of average salary).

Estimated national average yearly salary is 78,260 MYR (17,780 USD). Value indicated is pre-tax. Below graph shows estimated Tax Consultant job salary compared to average salary in Malaysia.

Comparison shows that a person working as Tax Consultant in Malaysia earns on average:

1.39 times the average salary (or 139% of average salary).

Is Tax Consultant a well paid job?

Yes, our data shows that Tax Consultant is a well paid job. With years and experience the salary might increase even further, resulting in higher satisfaction.What is considered a high salary for Tax Consultant?

High salary for Tax Consultant would be somewhere between 119,844 MYR and 157,976 MYR. However this is an estimation based on Gaussian Distribution.How much can you save working as Tax Consultant in Malaysia?

Living in Malaysia the approximate monthly expenses are: 711 USD. This amount covers basic needs such as food, housing, clothing, healthcare and education costs for a single person. No luxury expenses such as traveling, leisure, hobbies are included in the estimation.Estimated Yearly Salary: 108,949 MYR

Estimated Monthly Salary: 9,079 MYR

Estimated Weekly Salary: 2,095 MYR per week

Estimated Hourly Salary: 52 MYR per hour

By working as Tax Consultant a person can save up to 1,105 USD per month or 13,256 USD yearly. Values are pre-tax.

NOTE: These values are estimates and are averaged for the whole country. Furthermore the value is likely exaggerated as no other expenses are taken into account in the projection. Unessential expenses are very subjective and are difficult to assess. Most likely the previously estimated number is significantly lower for majority of people. Expenses in different cities across the country may vary. Above values accuracy is low and is based on limited set of data obtained.

For more information regarding expenses in Malaysia, see costs of living in Malaysia.

Salary comparison to region and neighbouring coutries

Country's neighbours are: Thailand, Indonesia, Singapore, Brunei, Vietnam, Philippines. To make it easier for comparison a conversion from local currency to USD has been made (conversion rates may vary).Estimated Yearly Salary for Tax Consultant

Salary increase per years of experience

Based on data available the salary increase per years of experience is as following- 0 years (beginner) equals base salary

- 1 to 5 years of experience yields

+12% salary increase

+12% salary increase- 6 to 10 years of experience yields

+25% salary increase

+25% salary increase- 11 to 15 years of experience yields

+16% salary increase

+16% salary increase- 16 to 25 years of experience yields

+9% salary increase

+9% salary increase- more than 25 years of experience yields

+10% salary increase

+10% salary increaseTop 10 highest salaries in Malaysia

(927,752 MYR per year, pre-tax.)

2. Cardiologist

(770,656 MYR per year, pre-tax.)

(748,723 MYR per year, pre-tax.)

(724,417 MYR per year, pre-tax.)

5. Neurosurgeon

(722,312 MYR per year, pre-tax.)

6. Urologist

(706,560 MYR per year, pre-tax.)

(706,212 MYR per year, pre-tax.)

(704,735 MYR per year, pre-tax.)

(704,523 MYR per year, pre-tax.)

10. Dermatologist

(703,305 MYR per year, pre-tax.)

Random salary:

Department chair (college university) (144,430 MYR per year, pre-tax.)

Business sales manager (93,129 MYR per year, pre-tax.)

Church choir director (28,982 MYR per year, pre-tax.)

Boat mechanic (48,523 MYR per year, pre-tax.)

Takeoff engineer (63,955 MYR per year, pre-tax.)

Feedback about these results

Please provide feedback by clicking buttons below if you find any of our salaries erroneous.

Link to this graph - use the following code to display the salary graph on your page:

<a href='https://optisalary.com/salary?country=malaysia&job=tax-consultant'><img src='https://optisalary.com/wp-content/graphs/salary/tax-consultant-salary-in-malaysia-2025.jpg' alt='tax consultant salary in malaysia 2025' title='tax consultant salary in malaysia 2025' /></a>

Please note:optisalary.com presents salary data for informational use only.

All salary figures on this website are for informational purposes exclusively. We compile data from various trusted databases, yet cannot ensure complete precision. Before making financial decisions, visitors should cross-check with additional authoritative sources. Salaries fluctuate due to several influences, including economic conditions, job market trends, and geographic location. We deny any liability for errors in the salary information provided here. Your engagement with this website constitutes acceptance of this disclaimer.

All salary figures on optisalary.com are for informational purposes only. We compile data from various reliable databases, yet do not guarantee complete accuracy. Before making career choices, visitors should consult external authoritative sources. Salaries fluctuate due to several influences, including negotiation skills, industry demand, and experience levels. We disclaim any responsibility for misrepresentations in the salary information provided here. Your use with optisalary.com indicates acceptance of this disclaimer.