Home > Salary > Kenya > International Tax Manager An international tax manager is responsible for overseeing and managing tax compliance and planning activities for multinational companies. They ensure that the company complies with international tax laws and regulations, while also maximizing tax efficiency and minimizing tax risks. This involves analyzing and interpreting complex tax laws, advising on cross-border transactions, and developing tax strategies to optimize the company's global tax position. International tax managers also collaborate with internal teams and external stakeholders, such as tax authorities and auditors, to ensure accurate reporting and timely filing of tax returns. They stay updated with changes in tax laws and regulations across different jurisdictions and provide guidance to mitigate potential risks and identify opportunities for tax savings. Attention to detail, strong analytical skills, and a deep understanding of international tax principles are crucial for success in this role.

An international tax manager is responsible for overseeing and managing tax compliance and planning activities for multinational companies. They ensure that the company complies with international tax laws and regulations, while also maximizing tax efficiency and minimizing tax risks. This involves analyzing and interpreting complex tax laws, advising on cross-border transactions, and developing tax strategies to optimize the company's global tax position. International tax managers also collaborate with internal teams and external stakeholders, such as tax authorities and auditors, to ensure accurate reporting and timely filing of tax returns. They stay updated with changes in tax laws and regulations across different jurisdictions and provide guidance to mitigate potential risks and identify opportunities for tax savings. Attention to detail, strong analytical skills, and a deep understanding of international tax principles are crucial for success in this role.

Estimated Yearly Salary: 2,229,561 KES

Estimated Monthly Salary: 185,797 KES

Estimated Weekly Salary: 42,876 KES per week

Estimated Hourly Salary: 1,072 KES per hour

Values are pre-tax

Values are pre-tax

Last revision of data: 2025-01-04

Last revision of data: 2025-01-04

Estimated Monthly Salary: 179,106 KES

Estimated Weekly Salary: 41,332 KES per week

Estimated Hourly Salary: 1,033 KES per hour

Last revision of data: 2024-01-06

Last revision of data: 2024-01-06

Estimated Yearly Salary: 14,028 USD

Estimated Monthly Salary: 1,169 USD

Estimated Weekly Salary: 270 USD per week

Estimated Hourly Salary: 7 USD per hour

Difference in salary year over year or average salary increase is approximately 4 %

4 %

Data confidence is - relatively high

Data fetched from dabase: 14 submissions.

Results are anonymized. Amounts indicated are pre-tax, meaning no deductionts yet have been made to the basic salary. Salaries where there are less than 3 entries are not displayed.

Want to check how your salary compares? Submit your own salary here

Estimated Yearly Salary: 2,229,561 KES

Estimated Monthly Salary: 185,797 KES

Estimated Weekly Salary: 42,876 KES per week

Estimated Hourly Salary: 1,072 KES per hour

By working as International Tax Manager a person can save up to 929 USD per month or 11,148 USD yearly. Values are pre-tax.

NOTE: These values are estimates and are averaged for the whole country. Furthermore the value is likely exaggerated as no other expenses are taken into account in the projection. Unessential expenses are very subjective and are difficult to assess. Most likely the previously estimated number is significantly lower for majority of people. Expenses in different cities across the country may vary. Above values accuracy is low and is based on limited set of data obtained.

For more information regarding expenses in Kenya, see costs of living in Kenya.

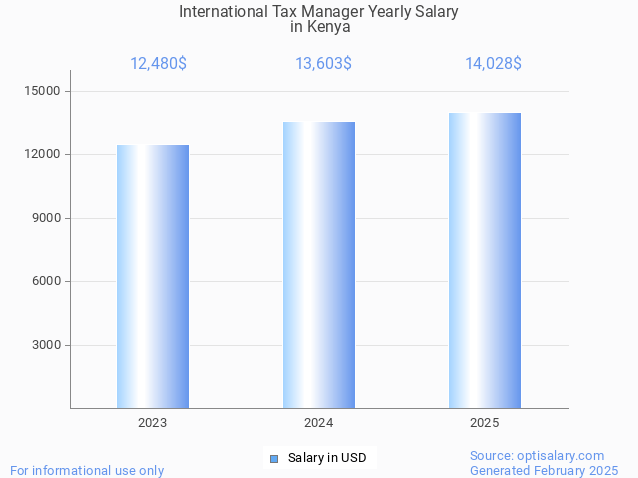

Estimated Yearly Salary for International Tax Manager

Last revision of data: 2025-01-04

Last revision of data: 2025-01-04

Data as of 2025

Data as of 2025

Random salary:

Associate software engineer (991,117 KES per year, pre-tax.)

Manufacturing technician aerospace (730,397 KES per year, pre-tax.)

Core driller (634,750 KES per year, pre-tax.)

Client development director (2,113,395 KES per year, pre-tax.)

Press set up (703,926 KES per year, pre-tax.)

International Tax Manager salary in Kenya

Average Yearly Salary of International Tax Manager in Kenya is approximately 2,229,561 KES (14,028 USD). Data is for 2025 and indicates a pre-tax value. The salary itself depends on multiple factors such as seniority, job performance, certifications, experience or any other bonuses. The value indicated is an average amount based on records we have in database. Real values may vary. The data is for orientational purposes.

What does International Tax Manager do?

An international tax manager is responsible for overseeing and managing tax compliance and planning activities for multinational companies. They ensure that the company complies with international tax laws and regulations, while also maximizing tax efficiency and minimizing tax risks. This involves analyzing and interpreting complex tax laws, advising on cross-border transactions, and developing tax strategies to optimize the company's global tax position. International tax managers also collaborate with internal teams and external stakeholders, such as tax authorities and auditors, to ensure accurate reporting and timely filing of tax returns. They stay updated with changes in tax laws and regulations across different jurisdictions and provide guidance to mitigate potential risks and identify opportunities for tax savings. Attention to detail, strong analytical skills, and a deep understanding of international tax principles are crucial for success in this role.

An international tax manager is responsible for overseeing and managing tax compliance and planning activities for multinational companies. They ensure that the company complies with international tax laws and regulations, while also maximizing tax efficiency and minimizing tax risks. This involves analyzing and interpreting complex tax laws, advising on cross-border transactions, and developing tax strategies to optimize the company's global tax position. International tax managers also collaborate with internal teams and external stakeholders, such as tax authorities and auditors, to ensure accurate reporting and timely filing of tax returns. They stay updated with changes in tax laws and regulations across different jurisdictions and provide guidance to mitigate potential risks and identify opportunities for tax savings. Attention to detail, strong analytical skills, and a deep understanding of international tax principles are crucial for success in this role.

Skills: international tax, tax compliance, tax planning, cross-border transactions, tax strategy, multinational companies

Job industry: Finance

Job industry: Finance

How much does International Tax Manager make?

Salary details

How much does International Tax Manager make?Estimated Yearly Salary: 2,229,561 KES

Estimated Monthly Salary: 185,797 KES

Estimated Weekly Salary: 42,876 KES per week

Estimated Hourly Salary: 1,072 KES per hour

Comparing salary to last year:

Estimated Yearly Salary: 2,149,274 KESEstimated Monthly Salary: 179,106 KES

Estimated Weekly Salary: 41,332 KES per week

Estimated Hourly Salary: 1,033 KES per hour

International Tax Manager estimated salary in USD

For easier comparison here is an estimated salary in USD:Estimated Yearly Salary: 14,028 USD

Estimated Monthly Salary: 1,169 USD

Estimated Weekly Salary: 270 USD per week

Estimated Hourly Salary: 7 USD per hour

Difference in salary year over year or average salary increase is approximately

4 %

4 % About these results

About these results

Data confidence is - relatively high Data fetched from dabase: 14 submissions.

Results are anonymized. Amounts indicated are pre-tax, meaning no deductionts yet have been made to the basic salary. Salaries where there are less than 3 entries are not displayed.

Want to check how your salary compares? Submit your own salary here

Compare salary to other countries

Please type in your occupation and select desired country to see latest trends in salaries.

Country:

Salary comparison to National average

Kenya is a country located in East Africa. It has a diverse population of approximately 53 million people. The land area of Kenya is around 580,367 square kilometers, making it the 48th largest country in the world. It is bordered by Ethiopia to the north, Somalia to the northeast, Tanzania to the south, Uganda to the west, and South Sudan to the northwest.

Estimated national average yearly salary is 869,520 KES (6,000 USD). Value indicated is pre-tax. Below graph shows estimated International Tax Manager job salary compared to average salary in Kenya.

Comparison shows that a person working as International Tax Manager in Kenya earns on average:

2.56 times the average salary (or 256% of average salary).

Estimated national average yearly salary is 869,520 KES (6,000 USD). Value indicated is pre-tax. Below graph shows estimated International Tax Manager job salary compared to average salary in Kenya.

Comparison shows that a person working as International Tax Manager in Kenya earns on average:

2.56 times the average salary (or 256% of average salary).

Is International Tax Manager a well paid job?

Yes, our data show that International Tax Manager is a very well paid job. With years and experience the salary might increase even further, resulting in higher satisfaction.What is considered a high salary for International Tax Manager?

High salary for International Tax Manager would be somewhere between 2,452,517 KES and 3,232,863 KES. However this is an estimation based on Gaussian Distribution.How much can you save working as International Tax Manager in Kenya?

Living in Kenya the approximate monthly expenses are: 240 USD. This amount covers basic needs such as food, housing, clothing, healthcare and education costs for a single person. No luxury expenses such as traveling, leisure, hobbies are included in the estimation.Estimated Yearly Salary: 2,229,561 KES

Estimated Monthly Salary: 185,797 KES

Estimated Weekly Salary: 42,876 KES per week

Estimated Hourly Salary: 1,072 KES per hour

By working as International Tax Manager a person can save up to 929 USD per month or 11,148 USD yearly. Values are pre-tax.

NOTE: These values are estimates and are averaged for the whole country. Furthermore the value is likely exaggerated as no other expenses are taken into account in the projection. Unessential expenses are very subjective and are difficult to assess. Most likely the previously estimated number is significantly lower for majority of people. Expenses in different cities across the country may vary. Above values accuracy is low and is based on limited set of data obtained.

For more information regarding expenses in Kenya, see costs of living in Kenya.

Salary comparison to region and neighbouring coutries

Country's neighbours are: Ethiopia, Somalia, South Sudan, Tanzania, Uganda.. To make it easier for comparison a conversion from local currency to USD has been made (conversion rates may vary).Estimated Yearly Salary for International Tax Manager

Salary increase per years of experience

Based on data available the salary increase per years of experience is as following- 0 years (beginner) equals base salary

- 1 to 5 years of experience yields

+12% salary increase

+12% salary increase- 6 to 10 years of experience yields

+25% salary increase

+25% salary increase- 11 to 15 years of experience yields

+16% salary increase

+16% salary increase- 16 to 25 years of experience yields

+9% salary increase

+9% salary increase- more than 25 years of experience yields

+10% salary increase

+10% salary increaseTop 10 highest salaries in Kenya

(9,866,711 KES per year, pre-tax.)

2. Cardiologist

(8,249,858 KES per year, pre-tax.)

(7,939,285 KES per year, pre-tax.)

4. Neurosurgeon

(7,706,816 KES per year, pre-tax.)

(7,676,980 KES per year, pre-tax.)

(7,545,448 KES per year, pre-tax.)

(7,519,239 KES per year, pre-tax.)

8. Urologist

(7,514,557 KES per year, pre-tax.)

9. Oncologist

(7,503,914 KES per year, pre-tax.)

(7,503,863 KES per year, pre-tax.)

Random salary:

Associate software engineer (991,117 KES per year, pre-tax.)

Manufacturing technician aerospace (730,397 KES per year, pre-tax.)

Core driller (634,750 KES per year, pre-tax.)

Client development director (2,113,395 KES per year, pre-tax.)

Press set up (703,926 KES per year, pre-tax.)

Feedback about these results

Please provide feedback by clicking buttons below if you find any of our salaries erroneous.

Link to this graph - use the following code to display the salary graph on your page:

<a href='https://optisalary.com/salary?country=kenya&job=international-tax-manager'><img src='https://optisalary.com/wp-content/graphs/salary/international-tax-manager-salary-in-kenya-2025.jpg' alt='international tax manager salary in kenya 2025' title='international tax manager salary in kenya 2025' /></a>

Please note:optisalary.com aggregates salary data for informational purposes only.

All salary figures on this website are for informational use exclusively. We compile data from numerous reliable databases, yet do not guarantee complete accuracy. Before making financial decisions, visitors should cross-check with external verified sources. Salaries change due to various influences, including negotiation skills, industry demand, and experience levels. We disclaim any responsibility for errors in the salary estimates provided here. Your engagement with this website indicates acceptance of this disclaimer.

Salary details displayed on this website are intended for informational use only. Our data comes from various sources and may not necessarily be up to date. Users should verify salary information independently before making financial decisions. The figures shown here may change due to variables such as location, industry standards, and individual skill sets. We do not guarantee that the information provided is error-free. By using this website, you accept that salary information is offered 'as is' and without warranties.