Home > Salary > Congo > Senior International Tax Manager A senior international tax manager is responsible for overseeing and managing the international tax planning and compliance activities of a company. They analyze and interpret complex tax laws and regulations, ensuring compliance with local and international tax requirements. This role involves developing and implementing tax strategies to optimize the company's tax position and minimize tax risks. Senior international tax managers also collaborate with cross-functional teams to provide tax advice on various business transactions, such as mergers, acquisitions, and expansion into new markets. They stay updated on changes in tax laws and regulations, assess their impact on the organization, and recommend appropriate actions. Additionally, they may be involved in negotiating tax incentives and resolving tax disputes with relevant authorities.

A senior international tax manager is responsible for overseeing and managing the international tax planning and compliance activities of a company. They analyze and interpret complex tax laws and regulations, ensuring compliance with local and international tax requirements. This role involves developing and implementing tax strategies to optimize the company's tax position and minimize tax risks. Senior international tax managers also collaborate with cross-functional teams to provide tax advice on various business transactions, such as mergers, acquisitions, and expansion into new markets. They stay updated on changes in tax laws and regulations, assess their impact on the organization, and recommend appropriate actions. Additionally, they may be involved in negotiating tax incentives and resolving tax disputes with relevant authorities.

Estimated Yearly Salary: 17,595,196 CDF

Estimated Monthly Salary: 1,466,266 CDF

Estimated Weekly Salary: 338,369 CDF per week

Estimated Hourly Salary: 8,459 CDF per hour

Values are pre-tax

Values are pre-tax

Last revision of data: 2025-01-04

Last revision of data: 2025-01-04

Estimated Monthly Salary: 1,416,157 CDF

Estimated Weekly Salary: 326,805 CDF per week

Estimated Hourly Salary: 8,170 CDF per hour

Last revision of data: 2024-01-08

Last revision of data: 2024-01-08

Estimated Yearly Salary: 7,228 USD

Estimated Monthly Salary: 602 USD

Estimated Weekly Salary: 139 USD per week

Estimated Hourly Salary: 3 USD per hour

Difference in salary year over year or average salary increase is approximately 4 %

4 %

Data confidence is - relatively high

Data fetched from dabase: 14 submissions.

Results are anonymized. Amounts indicated are pre-tax, meaning no deductionts yet have been made to the basic salary. Salaries where there are less than 3 entries are not displayed.

Want to check how your salary compares? Submit your own salary here

Estimated Yearly Salary: 17,595,196 CDF

Estimated Monthly Salary: 1,466,266 CDF

Estimated Weekly Salary: 338,369 CDF per week

Estimated Hourly Salary: 8,459 CDF per hour

By working as Senior International Tax Manager a person can save up to 506 USD per month or 6,076 USD yearly. Values are pre-tax.

NOTE: These values are estimates and are averaged for the whole country. Furthermore the value is likely exaggerated as no other expenses are taken into account in the projection. Unessential expenses are very subjective and are difficult to assess. Most likely the previously estimated number is significantly lower for majority of people. Expenses in different cities across the country may vary. Above values accuracy is low and is based on limited set of data obtained.

For more information regarding expenses in Congo, see costs of living in Congo.

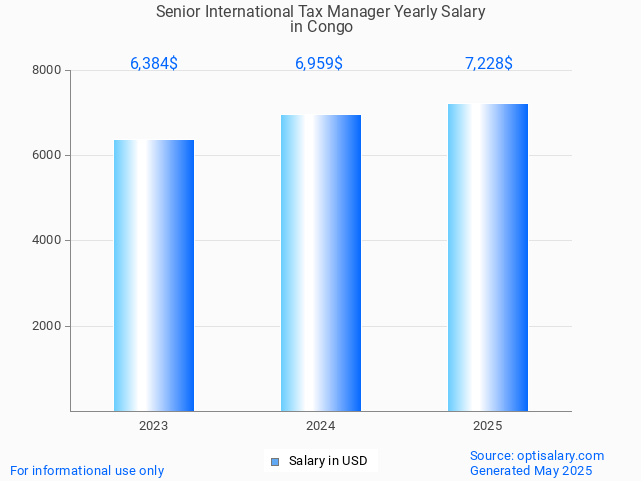

Estimated Yearly Salary for Senior International Tax Manager

Last revision of data: 2025-01-04

Last revision of data: 2025-01-04

Data as of 2025

Data as of 2025

Random salary:

Cad assistant (3,924,480 CDF per year, pre-tax.)

Navy lieutenant surface vessels (6,935,341 CDF per year, pre-tax.)

Immigration consultant (7,665,438 CDF per year, pre-tax.)

Hr assistant i (2,945,145 CDF per year, pre-tax.)

Document control supervisor (5,967,360 CDF per year, pre-tax.)

Senior International Tax Manager salary in Congo

Average Yearly Salary of Senior International Tax Manager in Congo is approximately 17,595,196 CDF (7,228 USD). Data is for 2025 and indicates a pre-tax value. The salary itself depends on multiple factors such as seniority, job performance, certifications, experience or any other bonuses. The value indicated is an average amount based on records we have in database. Real values may vary. The data is for orientational purposes.

What does Senior International Tax Manager do?

A senior international tax manager is responsible for overseeing and managing the international tax planning and compliance activities of a company. They analyze and interpret complex tax laws and regulations, ensuring compliance with local and international tax requirements. This role involves developing and implementing tax strategies to optimize the company's tax position and minimize tax risks. Senior international tax managers also collaborate with cross-functional teams to provide tax advice on various business transactions, such as mergers, acquisitions, and expansion into new markets. They stay updated on changes in tax laws and regulations, assess their impact on the organization, and recommend appropriate actions. Additionally, they may be involved in negotiating tax incentives and resolving tax disputes with relevant authorities.

A senior international tax manager is responsible for overseeing and managing the international tax planning and compliance activities of a company. They analyze and interpret complex tax laws and regulations, ensuring compliance with local and international tax requirements. This role involves developing and implementing tax strategies to optimize the company's tax position and minimize tax risks. Senior international tax managers also collaborate with cross-functional teams to provide tax advice on various business transactions, such as mergers, acquisitions, and expansion into new markets. They stay updated on changes in tax laws and regulations, assess their impact on the organization, and recommend appropriate actions. Additionally, they may be involved in negotiating tax incentives and resolving tax disputes with relevant authorities.

Skills: Senior International Tax Manager, Tax Compliance, Tax Planning, International Taxation, Cross-border Transactions, Tax Strategy.

Job industry: Accounting

Job industry: Accounting

How much does Senior International Tax Manager make?

Salary details

How much does Senior International Tax Manager make?Estimated Yearly Salary: 17,595,196 CDF

Estimated Monthly Salary: 1,466,266 CDF

Estimated Weekly Salary: 338,369 CDF per week

Estimated Hourly Salary: 8,459 CDF per hour

Comparing salary to last year:

Estimated Yearly Salary: 16,993,878 CDFEstimated Monthly Salary: 1,416,157 CDF

Estimated Weekly Salary: 326,805 CDF per week

Estimated Hourly Salary: 8,170 CDF per hour

Senior International Tax Manager estimated salary in USD

For easier comparison here is an estimated salary in USD:Estimated Yearly Salary: 7,228 USD

Estimated Monthly Salary: 602 USD

Estimated Weekly Salary: 139 USD per week

Estimated Hourly Salary: 3 USD per hour

Difference in salary year over year or average salary increase is approximately

4 %

4 % About these results

About these results

Data confidence is - relatively high Data fetched from dabase: 14 submissions.

Results are anonymized. Amounts indicated are pre-tax, meaning no deductionts yet have been made to the basic salary. Salaries where there are less than 3 entries are not displayed.

Want to check how your salary compares? Submit your own salary here

Compare salary to other countries

Please type in your occupation and select desired country to see latest trends in salaries.

Country:

Salary comparison to National average

Congo, officially known as the Democratic Republic of the Congo, is a country located in Central Africa. It is the second-largest country in Africa by land area, covering approximately 2,344,858 square kilometers. The country has a diverse population of around 87 million people, making it the fourth most populous nation in Africa.

Estimated national average yearly salary is 5,376,000 CDF (2,400 USD). Value indicated is pre-tax. Below graph shows estimated Senior International Tax Manager job salary compared to average salary in Congo.

Comparison shows that a person working as Senior International Tax Manager in Congo earns on average:

3.27 times the average salary (or 327% of average salary).

Estimated national average yearly salary is 5,376,000 CDF (2,400 USD). Value indicated is pre-tax. Below graph shows estimated Senior International Tax Manager job salary compared to average salary in Congo.

Comparison shows that a person working as Senior International Tax Manager in Congo earns on average:

3.27 times the average salary (or 327% of average salary).

Is Senior International Tax Manager a well paid job?

Yes, our data show that Senior International Tax Manager is a very well paid job. With years and experience the salary might increase even further, resulting in higher satisfaction.What is considered a high salary for Senior International Tax Manager?

High salary for Senior International Tax Manager would be somewhere between 19,354,716 CDF and 25,513,034 CDF. However this is an estimation based on Gaussian Distribution.How much can you save working as Senior International Tax Manager in Congo?

Living in Congo the approximate monthly expenses are: 96 USD. This amount covers basic needs such as food, housing, clothing, healthcare and education costs for a single person. No luxury expenses such as traveling, leisure, hobbies are included in the estimation.Estimated Yearly Salary: 17,595,196 CDF

Estimated Monthly Salary: 1,466,266 CDF

Estimated Weekly Salary: 338,369 CDF per week

Estimated Hourly Salary: 8,459 CDF per hour

By working as Senior International Tax Manager a person can save up to 506 USD per month or 6,076 USD yearly. Values are pre-tax.

NOTE: These values are estimates and are averaged for the whole country. Furthermore the value is likely exaggerated as no other expenses are taken into account in the projection. Unessential expenses are very subjective and are difficult to assess. Most likely the previously estimated number is significantly lower for majority of people. Expenses in different cities across the country may vary. Above values accuracy is low and is based on limited set of data obtained.

For more information regarding expenses in Congo, see costs of living in Congo.

Salary comparison to region and neighbouring coutries

Country's neighbours are: Angola, Burundi, Central African Republic, Republic of the Congo, Rwanda, South Sudan, Tanzania, Uganda, Zambia. To make it easier for comparison a conversion from local currency to USD has been made (conversion rates may vary).Estimated Yearly Salary for Senior International Tax Manager

Salary increase per years of experience

Based on data available the salary increase per years of experience is as following- 0 years (beginner) equals base salary

- 1 to 5 years of experience yields

+12% salary increase

+12% salary increase- 6 to 10 years of experience yields

+25% salary increase

+25% salary increase- 11 to 15 years of experience yields

+16% salary increase

+16% salary increase- 16 to 25 years of experience yields

+9% salary increase

+9% salary increase- more than 25 years of experience yields

+10% salary increase

+10% salary increaseTop 10 highest salaries in Congo

(61,032,702 CDF per year, pre-tax.)

2. Cardiologist

(50,760,840 CDF per year, pre-tax.)

(49,341,998 CDF per year, pre-tax.)

4. Neurosurgeon

(47,638,669 CDF per year, pre-tax.)

(47,491,524 CDF per year, pre-tax.)

6. Urologist

(46,611,779 CDF per year, pre-tax.)

(46,604,503 CDF per year, pre-tax.)

(46,427,807 CDF per year, pre-tax.)

9. Oncologist

(46,421,533 CDF per year, pre-tax.)

(46,354,315 CDF per year, pre-tax.)

Random salary:

Cad assistant (3,924,480 CDF per year, pre-tax.)

Navy lieutenant surface vessels (6,935,341 CDF per year, pre-tax.)

Immigration consultant (7,665,438 CDF per year, pre-tax.)

Hr assistant i (2,945,145 CDF per year, pre-tax.)

Document control supervisor (5,967,360 CDF per year, pre-tax.)

Feedback about these results

Please provide feedback by clicking buttons below if you find any of our salaries erroneous.

Link to this graph - use the following code to display the salary graph on your page:

<a href='https://optisalary.com/salary?country=congo&job=senior-international-tax-manager'><img src='https://optisalary.com/wp-content/graphs/salary/senior-international-tax-manager-salary-in-congo-2025.jpg' alt='senior international tax manager salary in congo 2025' title='senior international tax manager salary in congo 2025' /></a>

Please note:The salary estimates on optisalary.com are meant for informational use only.

The salary data on this site is designed for reference purposes exclusively. We offer salary insights derived from multiple datasets, but cannot guarantee complete precision. Users should always verify salary details with other reliable sources before making career-related choices. Variations in salary figures may occur due to several circumstances, including company policies, market demand, and individual skills. We do not offer any warranty regarding the entirety of the provided salary data. Use of optisalary.com implies acknowledgment of these conditions.

Salary information displayed on this site is informational exclusively. Our figures come from various sources, but we do not guarantee their accuracy. Users should always double-check salary details with official platforms before making job-related commitments. Salaries differ due to individual experience, market demand, and employer policies. We cannot offer any assurances about the completeness of the provided salary data. By navigating this site, you agree these terms.