Home > Salary > China > Tax Coordinator A tax coordinator is responsible for assisting in the coordination and management of various tax-related activities within an organization. This role involves working closely with tax professionals, clients, and internal teams to ensure compliance with tax regulations and deadlines. The tax coordinator's main duties include preparing and reviewing tax returns, organizing tax documentation, maintaining tax records, and conducting research on tax laws and regulations. They may also assist in resolving tax-related issues and communicating with tax authorities. Strong attention to detail, excellent organizational skills, and a good understanding of tax principles are essential for this role. Other important qualities include strong analytical skills, proficiency in using tax software and tools, and the ability to work well under pressure.

A tax coordinator is responsible for assisting in the coordination and management of various tax-related activities within an organization. This role involves working closely with tax professionals, clients, and internal teams to ensure compliance with tax regulations and deadlines. The tax coordinator's main duties include preparing and reviewing tax returns, organizing tax documentation, maintaining tax records, and conducting research on tax laws and regulations. They may also assist in resolving tax-related issues and communicating with tax authorities. Strong attention to detail, excellent organizational skills, and a good understanding of tax principles are essential for this role. Other important qualities include strong analytical skills, proficiency in using tax software and tools, and the ability to work well under pressure.

Estimated Yearly Salary: 54,676 CNY

Estimated Monthly Salary: 4,556 CNY

Estimated Weekly Salary: 1,051 CNY per week

Estimated Hourly Salary: 26 CNY per hour

Values are pre-tax

Values are pre-tax

Last revision of data: 2025-01-04

Last revision of data: 2025-01-04

Estimated Monthly Salary: 4,389 CNY

Estimated Weekly Salary: 1,013 CNY per week

Estimated Hourly Salary: 25 CNY per hour

Last revision of data: 2024-01-02

Last revision of data: 2024-01-02

Estimated Yearly Salary: 6,834 USD

Estimated Monthly Salary: 570 USD

Estimated Weekly Salary: 131 USD per week

Estimated Hourly Salary: 3 USD per hour

Difference in salary year over year or average salary increase is approximately 4 %

4 %

Data confidence is - relatively high

Data fetched from dabase: 14 submissions.

Results are anonymized. Amounts indicated are pre-tax, meaning no deductionts yet have been made to the basic salary. Salaries where there are less than 3 entries are not displayed.

Want to check how your salary compares? Submit your own salary here

Estimated Yearly Salary: 54,676 CNY

Estimated Monthly Salary: 4,556 CNY

Estimated Weekly Salary: 1,051 CNY per week

Estimated Hourly Salary: 26 CNY per hour

By working as Tax Coordinator a person can save up to 56 USD per month or 666 USD yearly. Values are pre-tax.

NOTE: These values are estimates and are averaged for the whole country. Furthermore the value is likely exaggerated as no other expenses are taken into account in the projection. Unessential expenses are very subjective and are difficult to assess. Most likely the previously estimated number is significantly lower for majority of people. Expenses in different cities across the country may vary. Above values accuracy is low and is based on limited set of data obtained.

For more information regarding expenses in China, see costs of living in China.

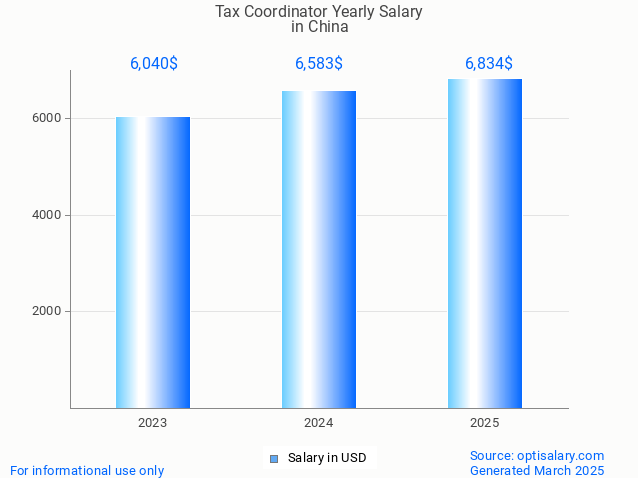

Estimated Yearly Salary for Tax Coordinator

Last revision of data: 2025-01-04

Last revision of data: 2025-01-04

Data as of 2025

Data as of 2025

Random salary:

It compliance specialist (122,713 CNY per year, pre-tax.)

Tax examiner collector or revenue agent (73,269 CNY per year, pre-tax.)

Medical equipment coordinator (67,179 CNY per year, pre-tax.)

Industrial firefighter (117,656 CNY per year, pre-tax.)

Distribution center (dc), operations supervisor (125,559 CNY per year, pre-tax.)

Tax Coordinator salary in China

Average Yearly Salary of Tax Coordinator in China is approximately 54,676 CNY (6,834 USD). Data is for 2025 and indicates a pre-tax value. The salary itself depends on multiple factors such as seniority, job performance, certifications, experience or any other bonuses. The value indicated is an average amount based on records we have in database. Real values may vary. The data is for orientational purposes.

What does Tax Coordinator do?

A tax coordinator is responsible for assisting in the coordination and management of various tax-related activities within an organization. This role involves working closely with tax professionals, clients, and internal teams to ensure compliance with tax regulations and deadlines. The tax coordinator's main duties include preparing and reviewing tax returns, organizing tax documentation, maintaining tax records, and conducting research on tax laws and regulations. They may also assist in resolving tax-related issues and communicating with tax authorities. Strong attention to detail, excellent organizational skills, and a good understanding of tax principles are essential for this role. Other important qualities include strong analytical skills, proficiency in using tax software and tools, and the ability to work well under pressure.

A tax coordinator is responsible for assisting in the coordination and management of various tax-related activities within an organization. This role involves working closely with tax professionals, clients, and internal teams to ensure compliance with tax regulations and deadlines. The tax coordinator's main duties include preparing and reviewing tax returns, organizing tax documentation, maintaining tax records, and conducting research on tax laws and regulations. They may also assist in resolving tax-related issues and communicating with tax authorities. Strong attention to detail, excellent organizational skills, and a good understanding of tax principles are essential for this role. Other important qualities include strong analytical skills, proficiency in using tax software and tools, and the ability to work well under pressure.

Skills: tax coordinator, tax compliance, tax regulations, tax returns, tax documentation, tax research

Job industry: Accounting

Job industry: Accounting

How much does Tax Coordinator make?

Salary details

How much does Tax Coordinator make?Estimated Yearly Salary: 54,676 CNY

Estimated Monthly Salary: 4,556 CNY

Estimated Weekly Salary: 1,051 CNY per week

Estimated Hourly Salary: 26 CNY per hour

Comparing salary to last year:

Estimated Yearly Salary: 52,664 CNYEstimated Monthly Salary: 4,389 CNY

Estimated Weekly Salary: 1,013 CNY per week

Estimated Hourly Salary: 25 CNY per hour

Tax Coordinator estimated salary in USD

For easier comparison here is an estimated salary in USD:Estimated Yearly Salary: 6,834 USD

Estimated Monthly Salary: 570 USD

Estimated Weekly Salary: 131 USD per week

Estimated Hourly Salary: 3 USD per hour

Difference in salary year over year or average salary increase is approximately

4 %

4 % About these results

About these results

Data confidence is - relatively high Data fetched from dabase: 14 submissions.

Results are anonymized. Amounts indicated are pre-tax, meaning no deductionts yet have been made to the basic salary. Salaries where there are less than 3 entries are not displayed.

Want to check how your salary compares? Submit your own salary here

Compare salary to other countries

Please type in your occupation and select desired country to see latest trends in salaries.

Country:

Salary comparison to National average

China is a vast country located in East Asia. It has the largest population in the world, with over 1.4 billion people. The country covers an expansive area of approximately 9.6 million square kilometers. China shares borders with 14 countries and has diverse geographical features, including mountains, plateaus, and plains.

Estimated national average yearly salary is 92,134 CNY (12,850 USD). Value indicated is pre-tax. Below graph shows estimated Tax Coordinator job salary compared to average salary in China.

Comparison shows that a person working as Tax Coordinator in China earns on average:

0.59 times the average salary (or 59% of average salary).

Estimated national average yearly salary is 92,134 CNY (12,850 USD). Value indicated is pre-tax. Below graph shows estimated Tax Coordinator job salary compared to average salary in China.

Comparison shows that a person working as Tax Coordinator in China earns on average:

0.59 times the average salary (or 59% of average salary).

Is Tax Coordinator a well paid job?

No, our data shows that Tax Coordinator is typically not a well-paid job. The salary varies based on experience. Meaning that even though Tax Coordinator might be a low paying job, with experience the salary might increase to satisfactory levels.What is considered a high salary for Tax Coordinator?

High salary for Tax Coordinator would be somewhere between 60,144 CNY and 79,280 CNY. However this is an estimation based on Gaussian Distribution.How much can you save working as Tax Coordinator in China?

Living in China the approximate monthly expenses are: 514 USD. This amount covers basic needs such as food, housing, clothing, healthcare and education costs for a single person. No luxury expenses such as traveling, leisure, hobbies are included in the estimation.Estimated Yearly Salary: 54,676 CNY

Estimated Monthly Salary: 4,556 CNY

Estimated Weekly Salary: 1,051 CNY per week

Estimated Hourly Salary: 26 CNY per hour

By working as Tax Coordinator a person can save up to 56 USD per month or 666 USD yearly. Values are pre-tax.

NOTE: These values are estimates and are averaged for the whole country. Furthermore the value is likely exaggerated as no other expenses are taken into account in the projection. Unessential expenses are very subjective and are difficult to assess. Most likely the previously estimated number is significantly lower for majority of people. Expenses in different cities across the country may vary. Above values accuracy is low and is based on limited set of data obtained.

For more information regarding expenses in China, see costs of living in China.

Salary comparison to region and neighbouring coutries

Country's neighbours are: Russia, Mongolia, Kazakhstan, Kyrgyzstan, Tajikistan, Afghanistan, Pakistan, India, Nepal, Bhutan, Myanmar (Burma), Laos, Vietnam, North Korea. To make it easier for comparison a conversion from local currency to USD has been made (conversion rates may vary).Estimated Yearly Salary for Tax Coordinator

Salary increase per years of experience

Based on data available the salary increase per years of experience is as following- 0 years (beginner) equals base salary

- 1 to 5 years of experience yields

+12% salary increase

+12% salary increase- 6 to 10 years of experience yields

+25% salary increase

+25% salary increase- 11 to 15 years of experience yields

+16% salary increase

+16% salary increase- 16 to 25 years of experience yields

+9% salary increase

+9% salary increase- more than 25 years of experience yields

+10% salary increase

+10% salary increaseTop 10 highest salaries in China

(1,075,420 CNY per year, pre-tax.)

2. Cardiologist

(893,602 CNY per year, pre-tax.)

(861,748 CNY per year, pre-tax.)

4. Neurosurgeon

(835,990 CNY per year, pre-tax.)

(833,048 CNY per year, pre-tax.)

6. Urologist

(818,021 CNY per year, pre-tax.)

(817,649 CNY per year, pre-tax.)

(817,013 CNY per year, pre-tax.)

(813,232 CNY per year, pre-tax.)

10. Oncologist

(812,783 CNY per year, pre-tax.)

Random salary:

It compliance specialist (122,713 CNY per year, pre-tax.)

Tax examiner collector or revenue agent (73,269 CNY per year, pre-tax.)

Medical equipment coordinator (67,179 CNY per year, pre-tax.)

Industrial firefighter (117,656 CNY per year, pre-tax.)

Distribution center (dc), operations supervisor (125,559 CNY per year, pre-tax.)

Feedback about these results

Please provide feedback by clicking buttons below if you find any of our salaries erroneous.

Link to this graph - use the following code to display the salary graph on your page:

<a href='https://optisalary.com/salary?country=china&job=tax-coordinator'><img src='https://optisalary.com/wp-content/graphs/salary/tax-coordinator-salary-in-china-2025.jpg' alt='tax coordinator salary in china 2025' title='tax coordinator salary in china 2025' /></a>

Please note:optisalary.com aggregates salary data for informational purposes exclusively.

This website displays salary data exclusively for informational use. While we strive for correctness, we cannot ensure the precision of all figures. Users should double-check salary details with official organizations before making career-related decisions. Salary estimates may vary based on multiple elements, such as geographic location, experience, and job role. We assume no responsibility for misinterpretations in the pay estimates provided. By using optisalary.com, you accept that salary data is subject to change.

This website compiles salary data for reference use only. While we strive to deliver correct figures, we cannot ensure their full precision. Users are highly advised to check with additional sources before finalizing financial decisions. Salary amounts vary based on several factors, such as industry trends, negotiation power, and regional demand. We do not offer any claims as to the validity of the listed information. Your access of this site acknowledges acceptance of this disclaimer.